What Are Meme Coins? The Ultimate Guide (2026)

Discover the fun, volatile world of meme coins and how they're shaping crypto culture. From Dogecoin to Pepe - complete guide for beginners and investors.

Table of Contents

Key Takeaways

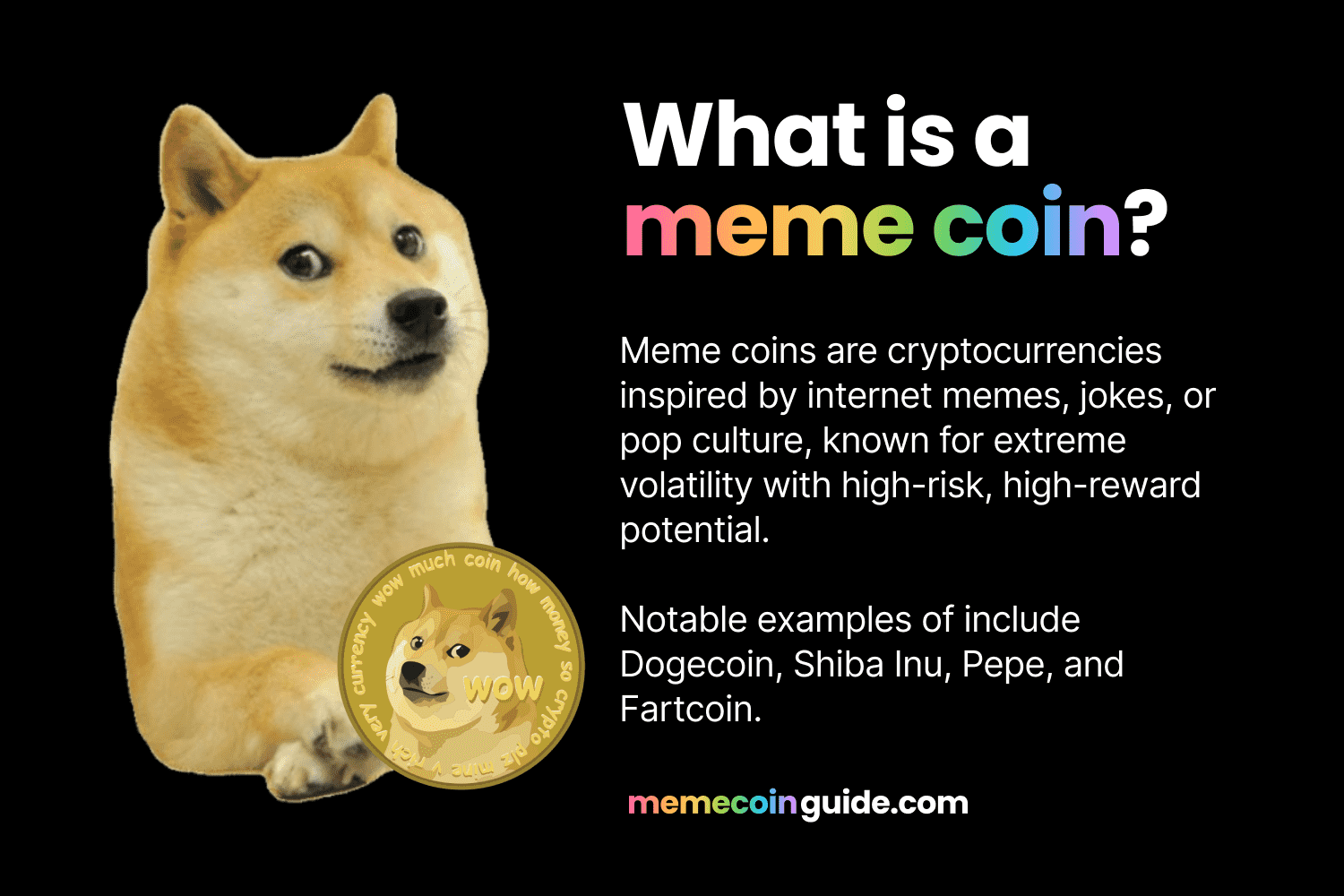

Meme coins are cryptocurrencies inspired by internet memes, jokes, or pop culture. Most attention and value come from community and social media rather than utility.

Meme coins are highly speculative. Prices can spike and crash quickly, so only risk what you can afford to lose.

Millions of meme coins exist, but few achieve lasting success. On Solana alone, more than 13 million meme coins have been created on pump.fun since 2024, but only a tiny share ever reach basic milestones or sustained their value.

Meme coins are often categorized into themes including "dog coins" like Dogecoin, Shiba Inu and dogwifhat, "cat coins" like Popcat, MEW and Keyboard Cat, political and celebrity meme coins, and other viral trend tokens.

The majority of established meme coins exist on Ethereum and Solana. A growing number are launching on other chains such as Base and BNB Chain.

Introduction

Have you ever scrolled through social media and stumbled upon a dog meme or a frog cartoon that's suddenly worth millions in the crypto world? If you're new to cryptocurrency, meme coins might seem like a wild, confusing corner of the market. But don't worry, we're here to break it down for you in simple terms.

Meme coins have turned internet jokes into billion-dollar crypto phenomena, blending blockchain with viral culture. From Dogecoin's iconic Shiba Inu to Pepe Coin's meme-frog frenzy, these tokens thrive on community hype and X-driven virality.

In this guide, we'll explore what meme coins are, how they work, and why they captivate traders and enthusiasts alike. Whether you're a crypto newbie or a seasoned investor, this article unpacks their history, risks, and potential, equipping you to navigate, buy, or even create the next viral token in this high-stakes, chaotic market. By the end, you'll have a clear picture of whether they're right for your crypto journey.

What is a Meme Coin?

A meme coin is a type of cryptocurrency that originate from internet jokes, viral trends or pop-culture events (think dogs, frogs and cartoon presidents).

Unlike utility-focused cryptocurrencies such as Bitcoin or Ethereum, it generally has no intrinsic function; its price is fueled almost entirely by community hype, social-media virality and speculative trading. Treat them as highly volatile and only risk what you can afford to lose.

Rules and enforcement vary by country. Regulators often look at how a token is offered, marketed, and used when assessing it. Always verify official details and check local guidance before you buy.

Well-known examples include Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE). Each shows how an internet meme can grow into a large, community-driven market, but gains are never guaranteed and losses can be significant.

How Meme Coins Work

Meme coins are born from internet culture, sparked by viral trends, jokes, catchphrases, news cycles, celebrity tweets, cartoons, or even AI-generated content. A creator launches a token on an existing blockchain such as Ethereum (examples: Shiba Inu, Pepe), Solana (example: Bonk), or on a native chain like Dogecoin.

After launch, the original creator may walk away. The community often takes over on Telegram, X, and Reddit, or a small team continues to build. Some projects hold intellectual property, for example Pudgy Penguins with Pengu. Others, such as Pepe, grow without formal IP because the community drives the narrative. In every case, value depends on the community: people make memes, post consistently, coordinate, and attract new holders.

You can buy meme coins on decentralized exchanges (DEXs) like Uniswap, or on centralized exchanges (CEXs) like Coinbase. Traders use tools to track new launches, follow "smart money", and monitor volatility across both high-cap and low-cap coins.

Most meme coins eventually lose momentum and fade or crash because of extreme volatility and thin liquidity. Only a small number reach large exchange listings on platforms such as Coinbase or Robinhood and achieve multi-year longevity.

Crypto Basics for Meme Coins

For beginners, here's a clear overview: a blockchain is a decentralized digital ledger that records transactions in a secure way using cryptography. Meme coins are simply tokens built on blockchains like Ethereum, Solana, or others. To use them, you need a wallet, for example, MetaMask for Ethereum or Phantom for Solana. These wallets hold your tokens and allow you to send and receive.

Whenever you move a token, you must pay a gas fee (a small transaction cost). Think of it like credit card processing fees. Visa may charge 2%, Amex 3%, or PayPal a set percent, except on blockchains, these fees vary by network and load. On Ethereum, gas fees tend to be higher, especially when the network is congested. On Solana, they remain very low, often just a few thousandths of a dollar.

It helps to understand that meme coins live on many different blockchains. But thanks to interoperability tools and cross-chain bridges, you can often swap or transfer tokens across chains seamlessly in one step (depending on the protocols you use).

History of Meme Coins

The meme coin era began in 2013, when software engineers Billy Markus and Jackson Palmer launched Dogecoin as a parody of the rapidly proliferating altcoin space. They drew inspiration from the viral "Doge" Shiba Inu meme, merging internet humor and cryptocurrency. Initially a tongue-in-cheek experiment, Dogecoin amassed a loyal community and showed that memes could carry real cultural and financial weight.

2013: The Origin of Meme Coins

The meme coin era began in 2013, when software engineers Billy Markus and Jackson Palmer launched Dogecoin as a parody of the rapidly proliferating altcoin space. They drew inspiration from the viral "Doge" Shiba Inu meme, merging internet humor and cryptocurrency. Initially a tongue-in-cheek experiment, Dogecoin amassed a loyal community and showed that memes could carry real cultural and financial weight.

2020-2021: Explosive Growth

The early 2020s brought a meme coin boom. Shiba Inu (SHIB) emerged in 2020, branding itself the :Dogecoin killer". Meanwhile, Dogecoin benefited from celebrity backing, including high-profile mentions by Elon Musk. The combination of speculation, social media, and meme culture pushed valuations to stratospheric levels.

2023: The Rise of Pepe and Edgier Memes

In 2023, Pepe (PEPE) became a defining meme coin. Launched quietly on Ethereum, it leveraged cultural nostalgia and viral momentum to achieve billion-dollar valuations, highlighting how memes with edgy appeal could spark major market moves.

2024-2025: A New Renaissance of Creativity

By 2024 and into 2025, the meme coin landscape entered a renaissance. Launchpads, especially on chains like Solana, enabled fast token creation. Memes transformed into tokens overnight, from viral animals and pop culture icons to AI-driven concepts. Many tokens rose rapidly, fueled by community hype and speculative fervor, though many also declined just as quickly. Notable examples during this period range from viral animal stars like Moo Deng (the pygmy hippo) and Pnut (the tragic squirrel story) to political tokens tied to Trump, and AI-driven memecoins like Fartcoin.

Types of Meme Coins

Meme coins come in themed flavors, reflecting pop culture trends. They're often categorized into themes like dog coins, cat coins, political memes, frog memes, or famous animals:

Dog-themed

Dogecoin

SHIB

Floki

Bonk

Dogwifhat

Cat-themed

Popcat

Aura

Keyboard Cat

Toshi

AI Memes

Fartcoin (conceptualized by AI as the perfect memecoin)

Political

Official TRUMP

Culture Memes

Mog

Giga

Troll

Famous Animals

Moo Deng

Pnut

Frog-themed

Fwog

Matt Furie Memes

Pepe

Brett

Brand Memes

Pengu

Rekt

Murad's Picks

Notable Crypto Twitter personality who released his own list of his best bets of memecoins

Stock Meme

SPX6900

Viral Memes

Chill Guy

Core Characteristics of Meme Coins

Meme coins are more than random tokens-they share key traits you can use to evaluate risk and opportunity:

Community-Driven Value

Successful meme coins rely on vibrant online communities. On platforms such as X, Reddit, Discord, and TikTok, holders post memes, promote narratives, and maintain visibility. That collective energy often becomes price momentum. The Shib Army behind Shiba Inu is a clear example-what began as a lighthearted token grew into a cultural movement with NFTs and charitable programs.

Extreme Volatility

Meme coin prices can skyrocket one day and crash the next, often triggered by social media trends, celebrity mentions, or viral events. In 2024, some meme coins posted multi-hundred-percent swings in just days or weeks-evidence of how sentiment can dominate fundamentals.

Speculative Nature

Many meme coins lack fundamental backing. They do not produce yield, generate cash flows, or offer utility. Their value comes from belief, hype, and narrative. The SEC's 2025 staff statement notes that many meme coins behave more like collectibles than securities since buyers do not expect profits via entrepreneurial efforts. That speculative foundation draws thrill-seekers but also heightens risk.

Accessible Entry Point

Meme coins often trade at fractions of a cent, so even small amounts of capital can buy large quantities. This low barrier makes them especially attractive to newcomers, enabling broader participation in the meme coin economy.

When combined, these traits-community-driven value, wild volatility, speculative foundations, and low-cost entry-shape the meme coin phenomenon. Proceed with caution, expect wide price swings, and demand transparency before you invest.

What Are the Most Popular Meme Coins?

The meme coin landscape is crowded, but a few tokens stand out for their market presence and cultural impact. Each coin has distinct traits: Dogecoin's simplicity and brand recognition, Shiba Inu's ecosystem (including Shibarium), and Pepe's hyper-viral community. Market performance varies, with Dogecoin and Shiba Inu consistently ranking among the top 20 cryptocurrencies by market cap as of 2025.

These are the top 12 meme coins by market cap:

1. Dogecoin

| OWN CHAINA fun, community-driven coin inspired by the "Doge" Shiba Inu meme, launched in 2013.

2. Shiba Inu

| ETHEREUMKnown as the "Dogecoin killer," it's an Ethereum-based coin with a huge community and DeFi ecosystem.

3. Pepe

| ETHEREUMPepe is an Ethereum-based meme coin inspired by the iconic Pepe the Frog internet meme.

4. Bonk

| SOLANABonk is a Solana-based meme coin featuring a playful dog theme, designed to energize the Solana community with its airdropped origins.

5. Official TRUMP

| SOLANAOfficial Trump is a Solana-based meme coin tied to Donald Trump's public persona, launched in 2025.

6. Pudgy Penguins

| SOLANAPudgy Penguins is a Solana-based meme coin rooted in the beloved Pudgy Penguins NFT and consumer brand.

7. SPX6900

| ETHEREUM & SOLANASPX6900 is an Ethereum and Solana-based meme coin that satirically aims to "flip" the stock market with its cult-like community.

8. Fartcoin

| SOLANAFartcoin is a Solana-based meme coin ideated by the Terminal of Truth AI as the "perfect memecoin," often mocked by traditional finance for outperforming tradfi.

9. dogwifhat

| SOLANAdogwifhat is a Solana-based meme coin featuring a Shiba Inu dog in a pink beanie.

10. Floki Inu

| ETHEREUMFloki is an Ethereum-based meme coin inspired by Elon Musk's Shiba Inu dog and Norse mythology.

11. Mog

| ETHEREUMMog is an Ethereum-based meme coin embodying "tokenized winning" through the joy cat emoji, pit viper sunglasses and "mogging" (domination).

12. Brett

| BASEBrett is a Base-based meme coin inspired by the laid-back character from Matt Furie's Boy's Club comic: Pepe's best friend.

13. Nietzschean Penguin

| SOLANANietzschean Penguin is a Solana meme coin blending Friedrich Nietzsche philosophy with penguin imagery, creating intellectual humor in the meme coin space.

How to Buy Meme Coins

Ready to jump into meme coins? Here's a concise guide to buying them safely and smartly.

1. Choose a meme coin

Choose a meme coin that interests you (e.g., Dogecoin, Pepe, Bonk). Research the project, check its community, and review basic metrics on our coin pages.

2. Identify the blockchain the meme coin lives on

Find out which blockchain the meme coin is on — most are on Ethereum or Solana, but some live on Base, BNB Chain, or other networks. This determines which wallet and exchange you'll need.

3. Decide where you want to buy - a CEX or a DEX

CEX (Centralized Exchange): Easier for beginners, offers fiat on-ramps, requires KYC verification. Examples: Coinbase, Binance, Kraken.

DEX (Decentralized Exchange): You control your funds, no KYC needed, but requires more setup. Examples: Uniswap (Ethereum), Jupiter (Solana).

4. If using a CEX

- Sign up for the exchange where the meme coin is listed

- Complete account verification (KYC)

- Fund your account with fiat or crypto

- Buy the meme coin directly on the exchange

5. If using a DEX

- Set up a wallet on the chain where the meme coin exists (e.g., MetaMask for Ethereum, Phantom for Solana)

- Fund it with the base currency (ETH for Ethereum, SOL for Solana)

- Connect to a DEX like Uniswap or Jupiter

- Swap the base currency for the meme coin

Where to Buy Meme Coins

Looking for the best place to buy meme coins? Your choices fall into three main buckets: launchpads, centralized exchanges (CEXs), and decentralized exchanges (DEXs). Pick based on your experience, custody preference, and coin availability.

Launchpads (Earliest Access)

Ideal for new token launches and pre-listing trades.

Solana: Moonshot, Bonk.fun

Multi-chain: Pump.fun

Why use them: Early access, low fees (often ~0.05-0.1 SOL on Solana), fast listings.

Know before you buy: High risk; verify the official contract address and check liquidity/lock status.

Centralized Exchanges (CEXs) — Easiest for Beginners

Best for popular meme coins already listed.

Examples: Coinbase, Binance, Kraken

Pros: Simple onboarding, fiat on-ramps (card/Apple Pay), high liquidity.

Cons: Requires KYC; exchange holds your funds unless you withdraw.

Typical use: Buy DOGE, SHIB, and other top meme coins, then transfer to your wallet for self-custody.

Decentralized Exchanges (DEXs) — Self-Custody and Variety

Trade directly from your wallet with more control.

Ethereum DEX: Uniswap (requires ETH for gas) + MetaMask

Solana DEX: Raydium/Jupiter (requires SOL for fees) + Phantom

Pros: Privacy, self-custody, access to long-tail tokens (e.g., Popcat).

Cons: You must manage wallets, gas/fees, slippage, and contract verification.

Why Meme Coins Matter

Meme coins aren't just about money; they're a celebration of internet and pop culture. Born from memes (shareable, humorous content that spreads virally), they capture the absurdity and joy of online life. Remember the "Doge" meme's broken English charm? It spawned DOGE, turning a joke into a community-driven force for good (e.g., charity donations).

Meme coins are cryptocurrencies rooted in internet culture, turning viral moments like jokes, political memes, cultural trends such as "locking in" or sensations like Moo Deng, the Thai hippo, into tradable assets. Most meme coins lack official endorsement from their subjects; Pepe Coin, for example, has no connection to its creator, Matt Furie, relying instead on community enthusiasm to fuel their success.

Risks of Meme Coins

Meme coins can be exciting, but they carry real risks that you should understand before you buy. Prices are driven largely by community sentiment and internet culture, which means value can rise or fall very quickly. Use this overview to make informed decisions and protect your capital.

Volatility

Meme coins are the rollercoaster of crypto. Prices can surge by multiples in a single day after a viral tweet or video, then collapse just as fast when attention fades. If you prefer steady returns, this level of hourly and daily price movement may not fit your risk profile.

Limited fundamentals

Many meme coins have little or no underlying utility. Value often depends on narrative, social media visibility, and community belief rather than usage or cash flows. When the community moves on to the next trend, demand can evaporate.

Liquidity and concentration risk

Thin liquidity can make it hard to exit during a sell-off. Holdings may be concentrated in a few wallets or team addresses, which increases the chance that a single seller can move the market.

Scams and impersonation

Hype attracts bad actors. Common tactics include fake token contracts, look-alike websites, and social accounts that impersonate projects or influencers. Never share private keys. Verify the contract address from official channels and avoid clicking unknown links.

Smart-contract and rug-pull risk

Unaudited or malicious contracts can include trading restrictions or functions that let insiders drain liquidity. Check whether liquidity is locked, review top holders, and look for independent code reviews where available.

Platform and regulatory risk

Listings can be added or removed without notice. Access to certain tokens may change by region, payment method, or policy updates. Compliance reviews, KYC requirements, and tax rules can affect your ability to deposit, trade, or withdraw.

Behavioral risk

Fear of missing out and herd behavior can lead to poor timing and overexposure. Set position limits, plan exits, and avoid investing money you cannot afford to lose.

How to reduce risk

Verify the contract address, start with small test transactions, use reputable exchanges or well-known DEXs, enable two-factor authentication, store long-term holdings in secure wallets, and track all-in costs including network fees and spreads. Do your own research and seek multiple independent sources before you buy.

Legal Landscape of Meme Coins

Navigating the legal world of meme coins can feel like decoding a cryptic meme itself, so it's crucial to check the laws in your country.

Here's what the U.S. says: in early 2025, the U.S. Securities and Exchange Commission (SEC) stated that transactions in meme coins-those inspired by internet trends and driven by community hype-generally do not qualify as securities under federal law, meaning they don't require SEC registration. This view stems from the fact that meme coins, like collectibles, lack inherent value or a promise of profits from others' efforts, aligning them more with commodities than investment contracts under the Howey Test. However, this isn't a free-for-all. Fraud, manipulation, or pump-and-dump schemes tied to meme coins remain actionable under other federal and state laws, enforced by agencies like the CFTC, which oversees commodities.

How to Create a Meme Coin

Want to launch your own meme coin? It's easier than ever with user-friendly launchpads, especially on Solana. Here's a step-by-step guide to get you started:

1. Pick your meme coin concept

Choose a viral idea, trending meme, or funny concept that people will instantly recognize and want to share. Give your coin a catchy name and ticker symbol.

2. Select your blockchain

Decide which blockchain to use. Solana is popular for low fees and speed, Ethereum for established infrastructure, Base for easy access, and BNB Chain for lower costs.

3. Choose your launchpad

Pick a launchpad based on your blockchain. Popular options include Pump.fun, Bonk.fun, Jupiter Studio, and Moonshot. These platforms let you create tokens with no coding required.

4. Set up a wallet

Connect a compatible wallet—Phantom or Solflare for Solana, MetaMask for Ethereum or BNB Chain. Fund it with the native token (SOL, ETH, or BNB) for fees and initial liquidity.

5. Create your token

Enter your coin's name, ticker, logo, and description on the launchpad. Add initial liquidity to enable trading. The process typically takes just a few minutes.

6. Grow your community

Build hype on X (Twitter), Reddit, and Discord. Share memes, engage with your community, run contests, and be transparent to build trust and avoid scam accusations.

Future of Meme Coins

What's next for meme coins? Amid a shifting global financial climate-marked by Bitcoin's $118,000 peak and rising interest in decentralized assets-meme coins could evolve from internet novelties into mainstream players, blending viral appeal with utility like NFT marketplaces or community charities, as seen with Moo Deng.

However, with 99.999% of all meme coins historically failing (rugging, slow rugging, scamming, or just dying off of lack of community interest), discovering a memecoin in it's infancy that becomes a massive success is akin to finding a needle in a haystack, success remains rare-though, as the saying goes, "So you're saying there's a chance?" Don't risk more than you can afford to lose; consider it like a lottery ticket-this is not financial advice, as memecoins are extremely risky and have no inherent value.